A judge recently ruled that Bitcoin is a means of payment and therefore it qualifies as money:

Bitcoins are funds within the plain meaning of that term. Bitcoins can be accepted as a payment for goods and services or bought directly from an exchange with a bank account. They therefore function as pecuniary resources and are used as a medium of exchange and a means of payment.

This legal decision comes at a time when Bitcoin is indeed drawing more attention. For one, it was a paramount chunk of Mr. Robot’s second season and we are pretty sure the series drove many people into googling facts about Bitcoin.

Being cyber security enthusiasts closely researching the latest malware threats, we are mostly accustomed to mentioning Bitcoin in terms of ransomware payments. However, Bitcoin takes part in other, legal affairs and any above-average cryptocurrency devotee is perhaps acquainted with the facts we are about to unveil.

Q: What Should I Know about Bitcoin? What Does the Future Hold for Bitcoin?

A: Every computer can be a Bitcoin computer.

Balaji Srinivasan is the co-founder and CEO of 21 Inc. He recently announced the launch of the 21 software package during the Consensus 2016 blockchain conference. What would this specific software do? It would enable anyone with a computer to receive bitcoin.

The software is allows connected devices to join the 21 network and be connected with the 21 Marketplace.

Previously, such capabilities were only available to owners of the 21 Bitcoin Computer.

This leads to two more questions.

What is 21 Inc and what is the 21 Bitcoin Computer?

21 Inc is perhaps the most controversial and intriguing Bitcoin startup ever brought to life. The company was founded in 2013 by Balaji Srinivasan and Matthew Pauker. The startup has raised the mind-boggling $116 million from investors. In September 2015, 21 Inc released its first product – the highly anticipated 21 Bitcoin Computer. This is indeed the first Bitcoin computer in the world. As you probably think, expert opinions and reviews on the innovative device vary.

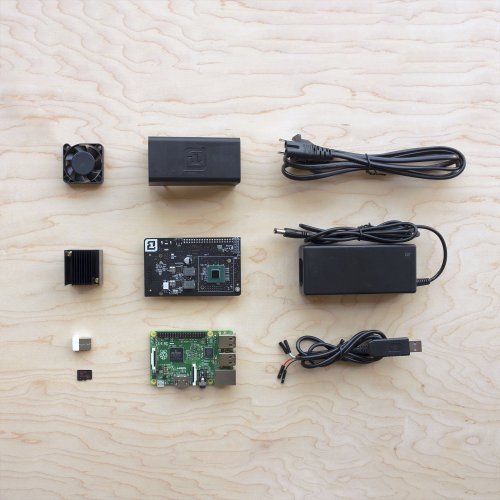

CoinGecko’s Dong Mai ordered the computer for the purpose of reviewing it. This is what it looks like (image taken from Amazon):

The first step to set up a 21 Bitcoin Computer is to follow the instructions on the black sheet and visit the Setup Page. The 21.co website has instructions for connecting the 21 Bitcoin Computer to a Windows, Mac or Linux laptop and even configuring it as a standalone Linux box.

However, although the guide said that the entire setup process would take only 10-15 minutes, my personal experience proved that this statement was totally wrong. In fact, I had so much trouble following the instructions that it took me about 3 days and a lot of compromises to finally get my computer up and running.

Other experts were agitated by the fact that a Linux-based device built on a Raspberry Pi had such a high price considering that it would never mine enough Bitcoins to pay for that value. The current price of the device at Amazon is $399.99. Other reviews highlighted the fact that the machine wasn’t your average Bitcoin mining product but an innovative platform to showcase new ways to use the technology.

CEO Balaji Srinivasan said in a blog post that his company’s vision was not necessarily building a chip but developing a full technology stack around the chip. “At 21 we are less concerned with bitcoin as a financial instrument and more interested in bitcoin as a protocol - and particularly in the industrial uses of bitcoin enabled by embedded mining“, he wrote.

A: There’s an inner battle going on at Bitcoin to define the cryptocurrency’s future.

The Bitcoin XT vs. Bitcoin Classic vs. Bitcoin Unlimited Controversy

Broadly known as Satoshi client, Bitcoin QT, or Bitcoin Core, the original Bitcoin concept as proposed by Satoshi Nakamoto, has always been the standard for Bitcoin’s consensus rules.

Bitcoin XT, the Bitcoin implementation by Mike Hearn, was the first fork of that original concept. Basically, Bitcoin XT is set to break existing consensus so that Bitcoin’s block-size limit is increased from 1 megabyte to 8 megabytes, a value which should double every other year until the reach of 8 gigabytes. Bitcoin XT hasn’t succeeded in attracting sufficient followers among the Bitcoin community.

Bitcoin Classic is also a fork of Bitcoin Core. The purpose of the Classic fork is to increase the transaction processing capacity of Bitcoin by increasing its block size limit. What Bitcoin Classis offers is a single increase of the maximum block size from 1 MB to 2 MB. The Classic fork can also be perceived as an attempt to broaden the governance of Bitcoin so that a larger community is included in the process.

Bitcoin Unlimited is all about the absence of a hard-coded block-size limit and it enables users to manually set this limit on their own nodes. According to CoinDesk.com:

Having launched earlier this year, Bitcoin Unlimited grew out of an active movement to quickly pick up bitcoin’s userbase by increasing the block size, or a hardcoded limit on the number of transactions that the network can process per block. This is a contentious change that many Bitcoin Core developers don’t support.

Curiously, the alternative Bitcoin has recently received approximately half a million dollars in a single donation from an anonymous party. This means that the fork is definitely regaining attention as we speak.

On September 21 2016, just a few days ago, Bitcoin investor Roger Ver’s mining pool mined its first Bitcoin Unlimited block, block 430757. To further popularize their attempts, the Bitcoin Unlimited community recently held a conference in San Francisco, called “Satoshi’s Vision: Bitcoin Development & Scaling Conference”.

А: Not only criminals are using Bitcoin…

A report by Aaron Yelowitz & Matthew Wilson, titled ‘Characteristics of Bitcoin users: an analysis of Google search data’ (published January 7, 2015) reveals four basic groups that use Bitcoin the most:

- Computer programming enthusiasts;

- Speculative investors;

- Llibertarians;

- Criminals.

The researchers’ discoveries mirror the results of a 2013 survey based on 1,000 Bitcoin users. The survey found that the average Bitcoin user is a 32-year-old libertarian male.

A: Banks are already creating a global blockchain payments network.

Bank of America, Santander and the Royal Bank of Canada have recently announced that they have joined forces to develop a global blockchain payments network via the Ripple’s distributed ledger technology. Other banks that are part of the initiative are UniCredit, Standard Chartered, Canadian bank CIBC and the Westpac Banking Corporation. Their purpose is to create a service similar to SWIFT but with a prompt settlement times.

The first step for the initiative is a standardized agreement that settles the terms and conditions which a bank must agree to in order to participate, specifying how transactions will be handled and the types of information that will be exchanged.

The second step is creating a “functional standards document” that will enable different banks to collaborate across currencies and jurisdictions.

References

https://www.coindesk.com

https://bitcoinmagazine.com